Page 60 - compilation-containing-the-charter-and-revised-ordinances-of-the-city-of-lake-city-florida-(1912)-gillen-and-hodges

P. 60

Charter and Revised Ordinances of Lake City Florida (1912) Gillen & Hodges

Charter of the City of Lake City

57

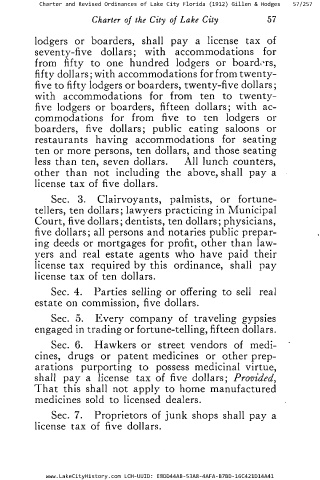

lodgers or boarders, shall pay a license tax of

seventy-five dollars; with accommodations for

from fifty to one hundred lodgers or boarders, 57/257

fifty dollars; with accommodations for from twenty-

five to fifty lodgers or boarders, twenty-five dollars;

with accommodations for from ten to twenty-

five lodgers or boarders, fifteen dollars; with ac

commodations for from five to ten lodgers or

boarders, five dollars; public eating saloons or

restaurants having accommodations for seating

ten or more persons, ten dollars, and those seating

less than ten, seven dollars. All lunch counters,

other than not including the above, shall pay a

license tax of five dollars.

Sec. 3. Clairvoyants, palmists, or fortune

tellers, ten dollars; lawyers practicing in Municipal

Court, five dollars; dentists, ten dollars; physicians,

five dollars; all persons and notaries public prepar

ing deeds or mortgages for profit, other than law

yers and real estate agents who have paid their

license tax required by this ordinance, shall pay

license tax of ten dollars.

Sec. 4. Parties selling or offering to sell real

estate on commission, five dollars.

Sec. 5. Every company of traveling gypsies

engaged in trading or fortune-telling, fifteen dollars.

Sec. 6. Hawkers or street vendors of medi

cines, drugs or patent medicines or other prep

arations purporting to possess medicinal virtue,

shall pay a license tax of five dollars; Provided,

That this shall not apply to home manufactured

medicines sold to licensed dealers.

Sec. 7. Proprietors of junk shops shall pay a

license tax of five dollars.

www.LakeCityHistory.com LCH-UUID: E8DD44AB-53A8-4AFA-B7BD-16C421D14A41